2024 Schedule A Form 1040 Schedule – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . In most cases, homeowners can report the amount on this form on line 8a of Schedule A (Form 1040). However, the allowable deduction amount may differ in certain circumstances, such as if the property .

2024 Schedule A Form 1040 Schedule

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

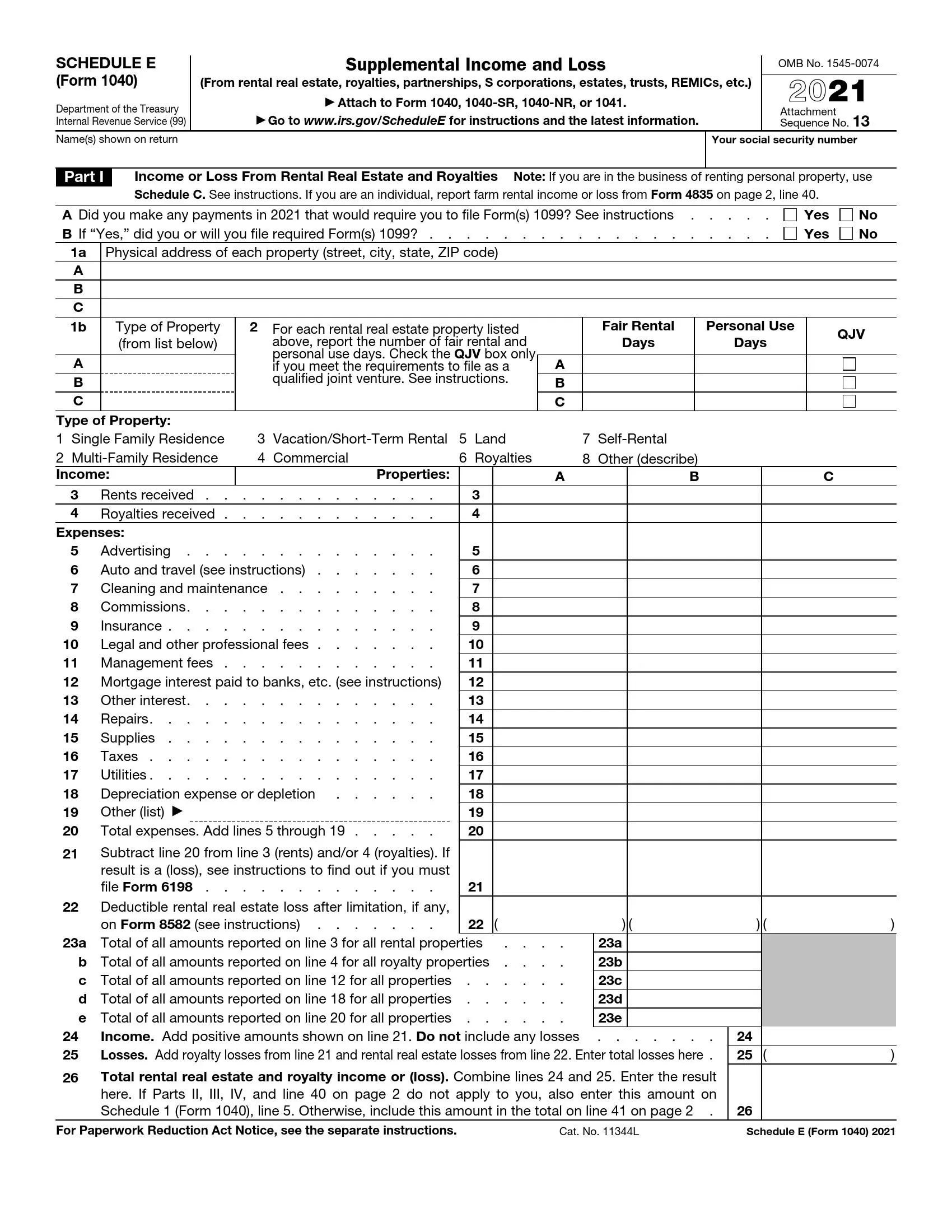

Source : www.incometaxgujarat.orgIRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

Source : formspal.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comWhat Is Schedule A of Form 1040?

Source : www.thebalancemoney.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

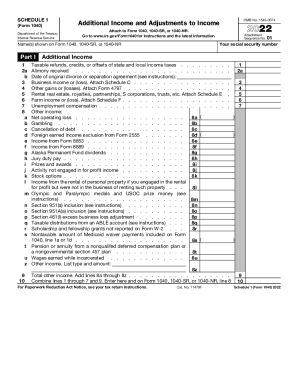

Source : thecollegeinvestor.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comWhen Is Schedule D (Form 1040) Required?

Source : www.investopedia.comIRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.com2024 Schedule A Form 1040 Schedule All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: The Schedule 1 form is used to report additional income or adjustments to income that are not listed on the standard Form 1040. It includes sections for reporting income from rental real estate . The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-e2490b265c7e42d1b79c9d70835003fd.png)

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)